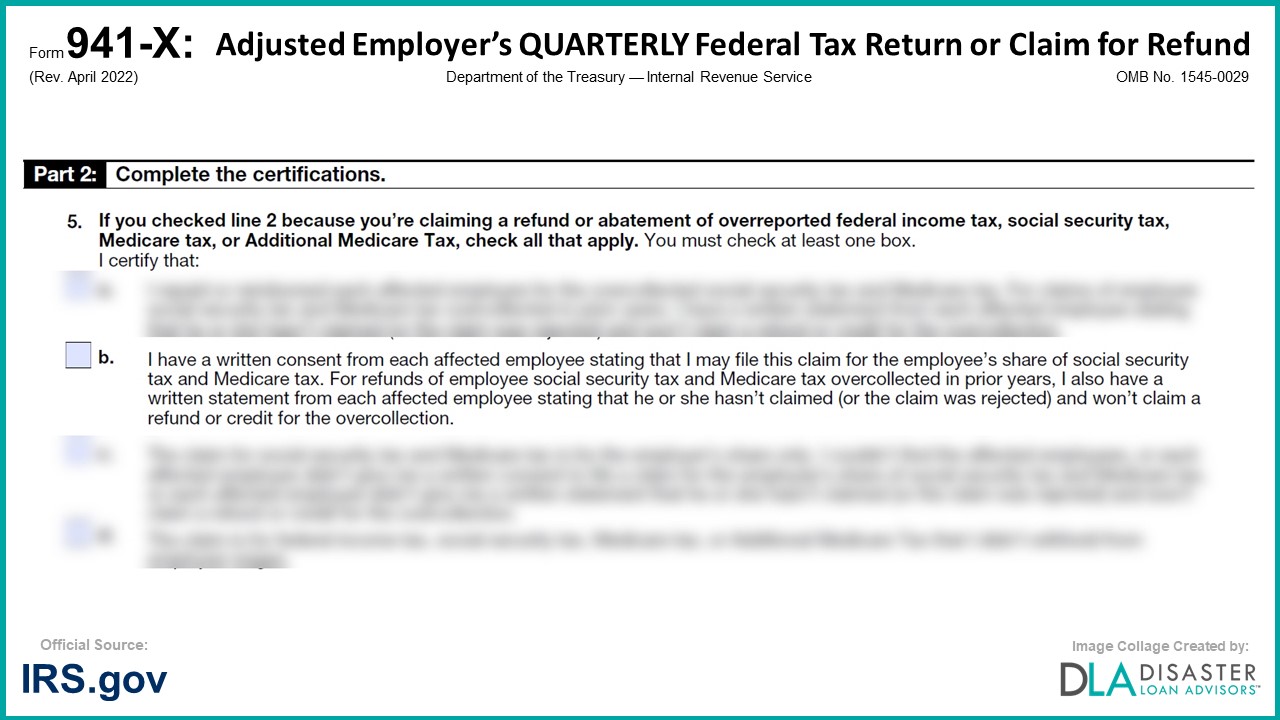

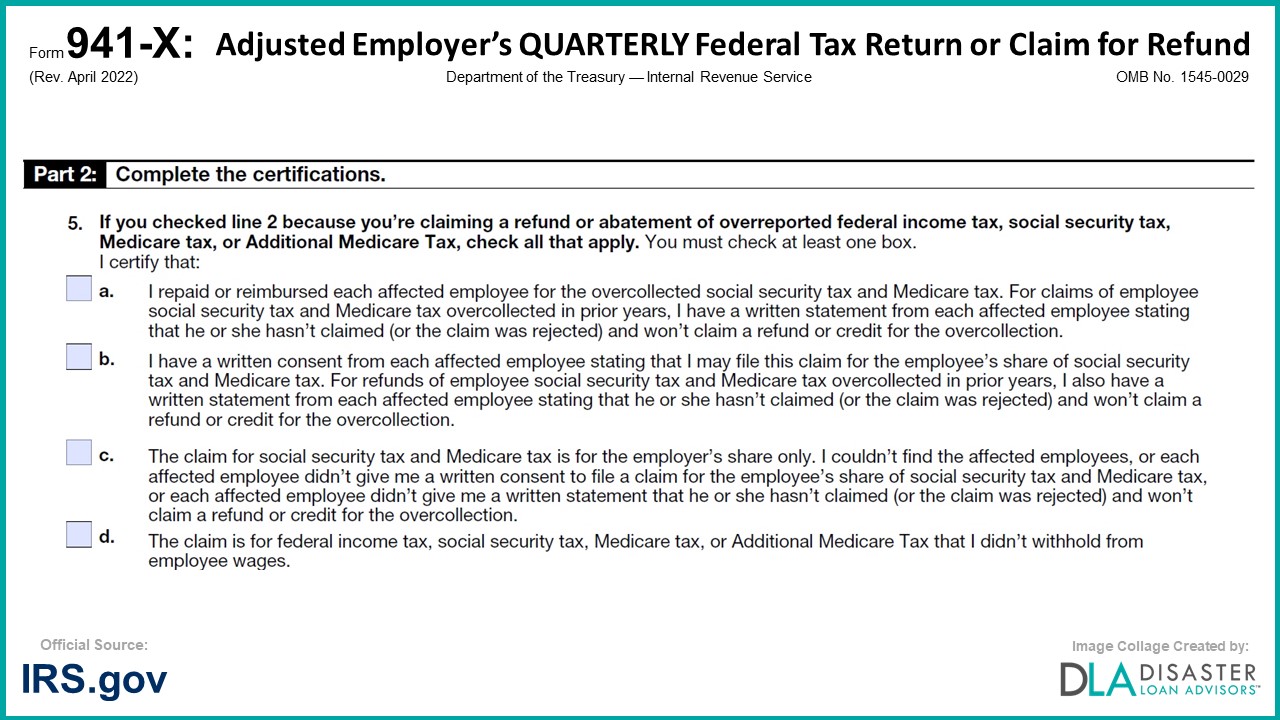

The “Certifying Claims” section is listed as question #5b under Part 2 of Form 941-X, which is needed to claim…

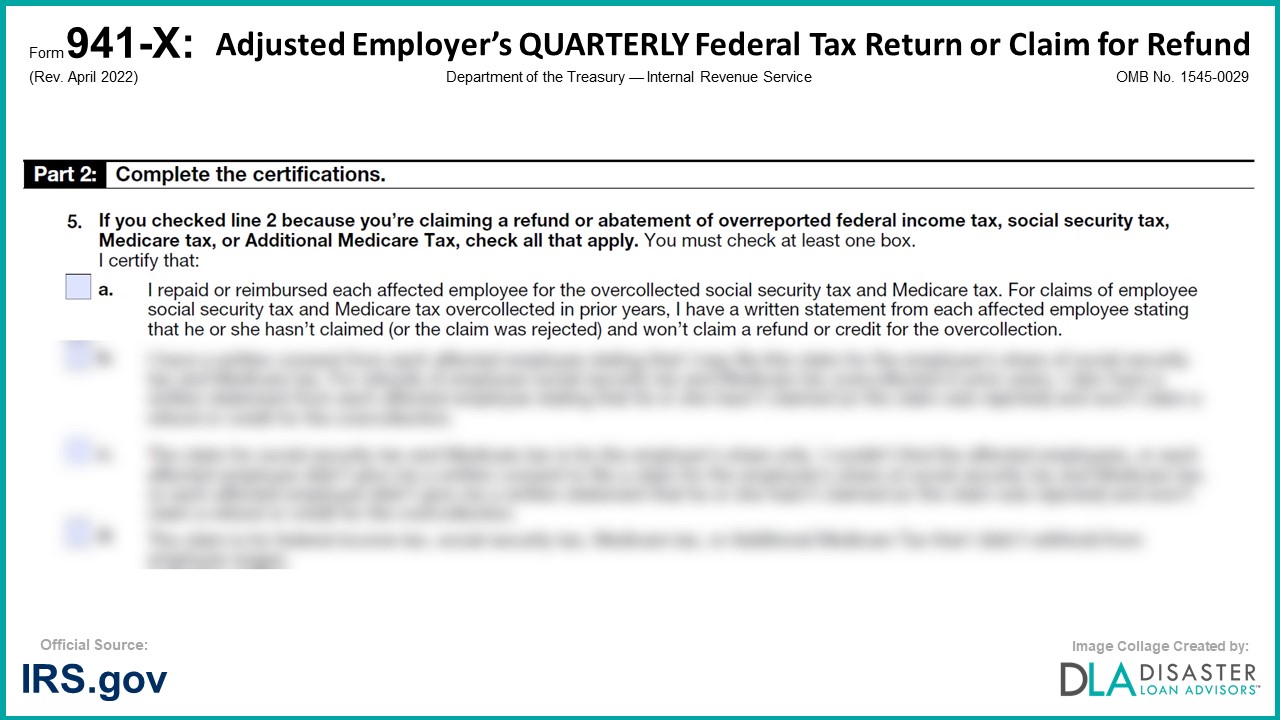

The “Certifying Claims” section is listed as question #5a under Part 2 of Form 941-X, which is needed to claim…

The “Certifying Claims” section is listed as question #5 under Part 2 of Form 941-X, which is needed to claim…

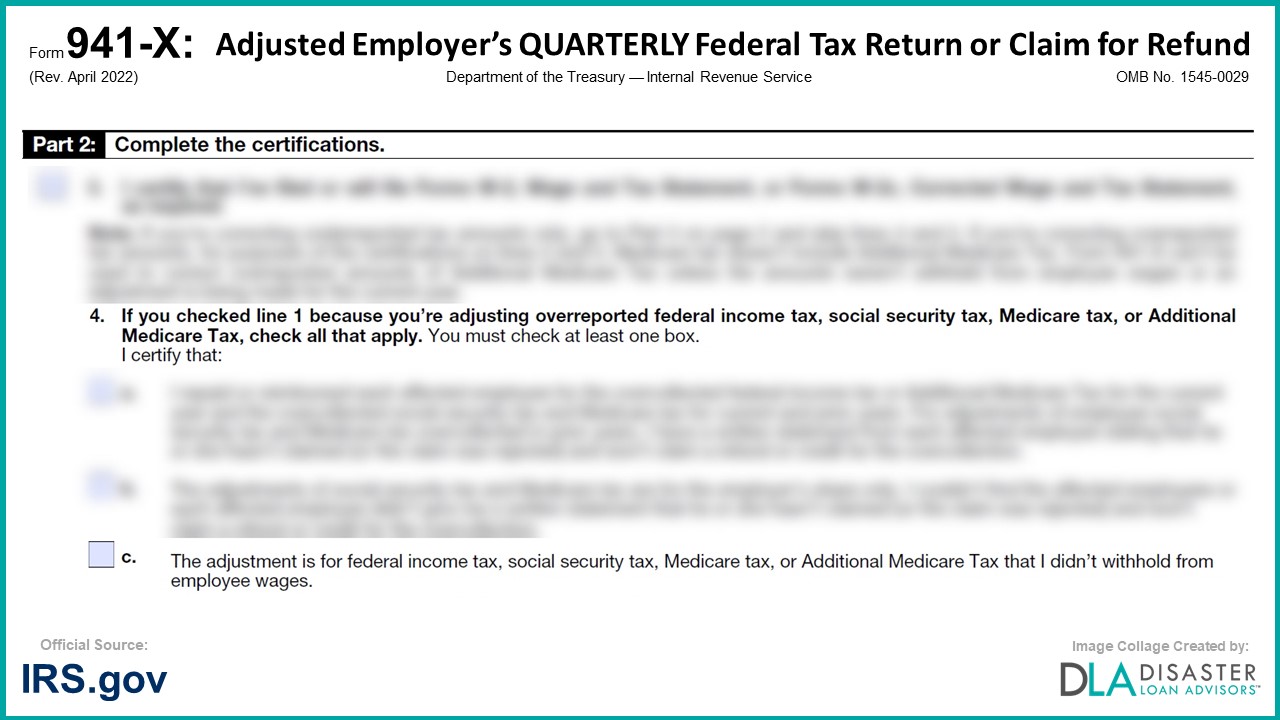

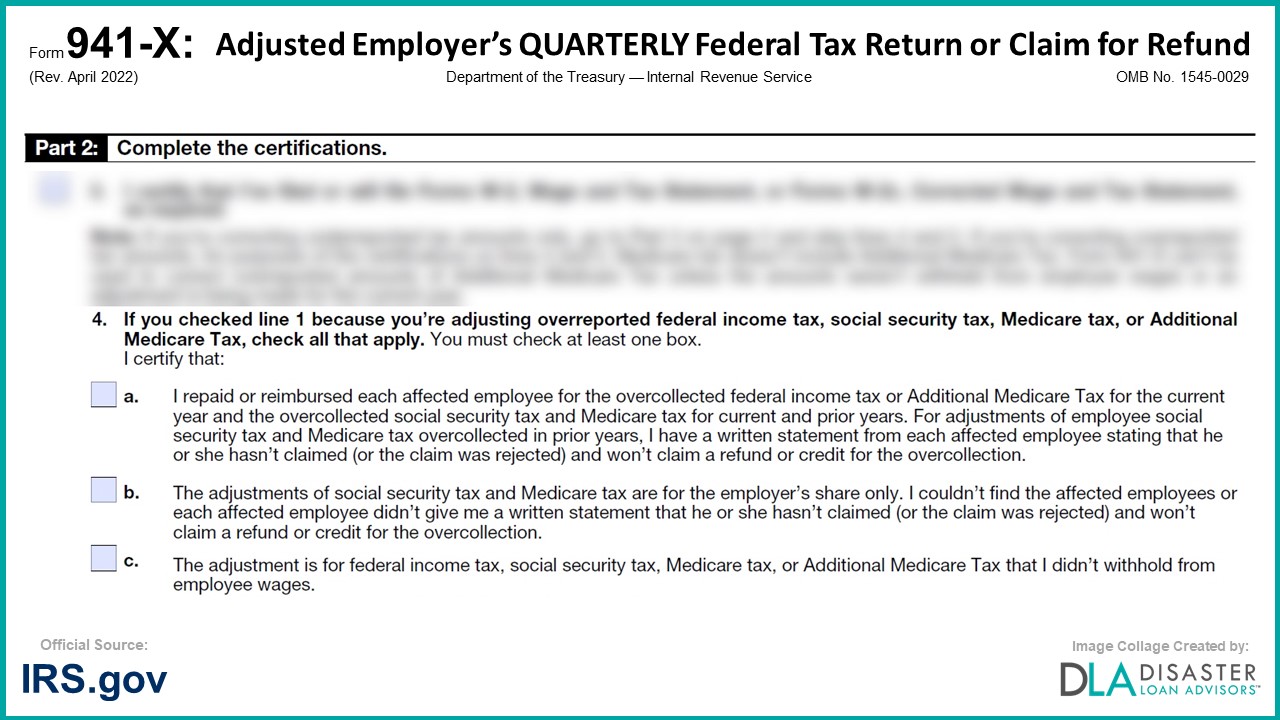

The “Certifying Overreporting Adjustments” section is listed as question #4c under Part 2 of Form 941-X, which is needed to…

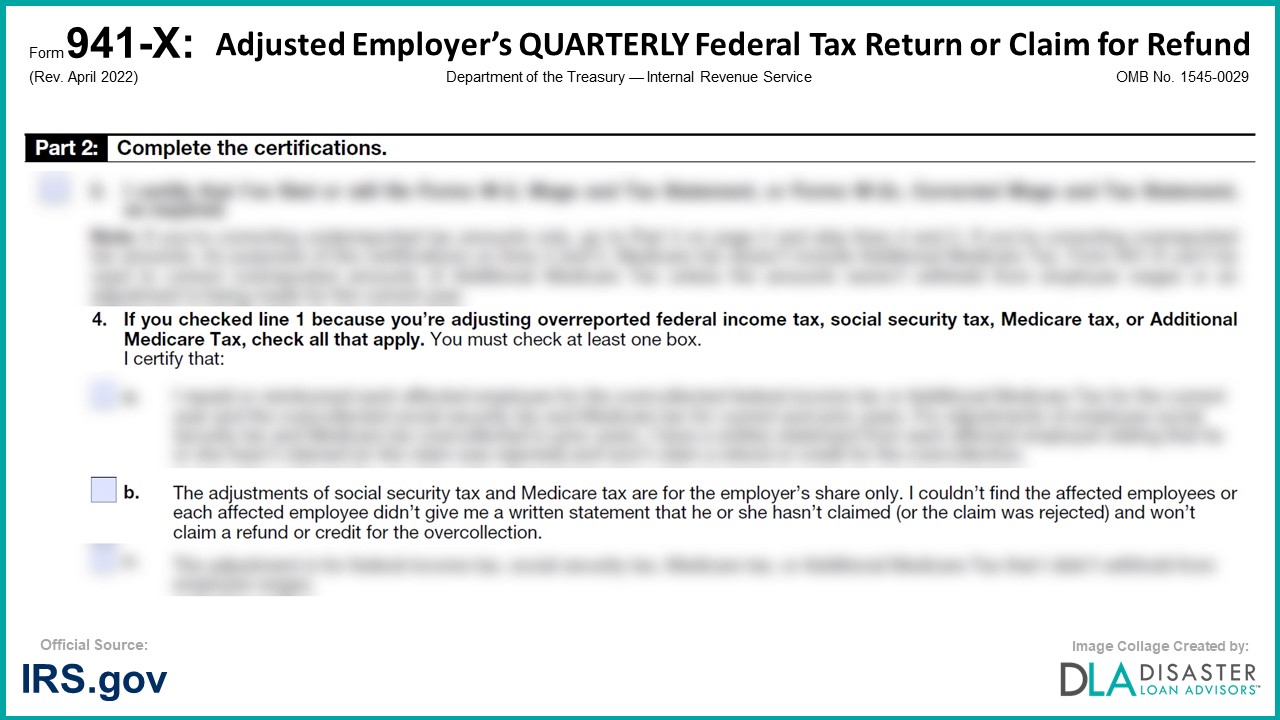

The “Certifying Overreporting Adjustments” section is listed as question #4b under Part 2 of Form 941-X, which is needed to…

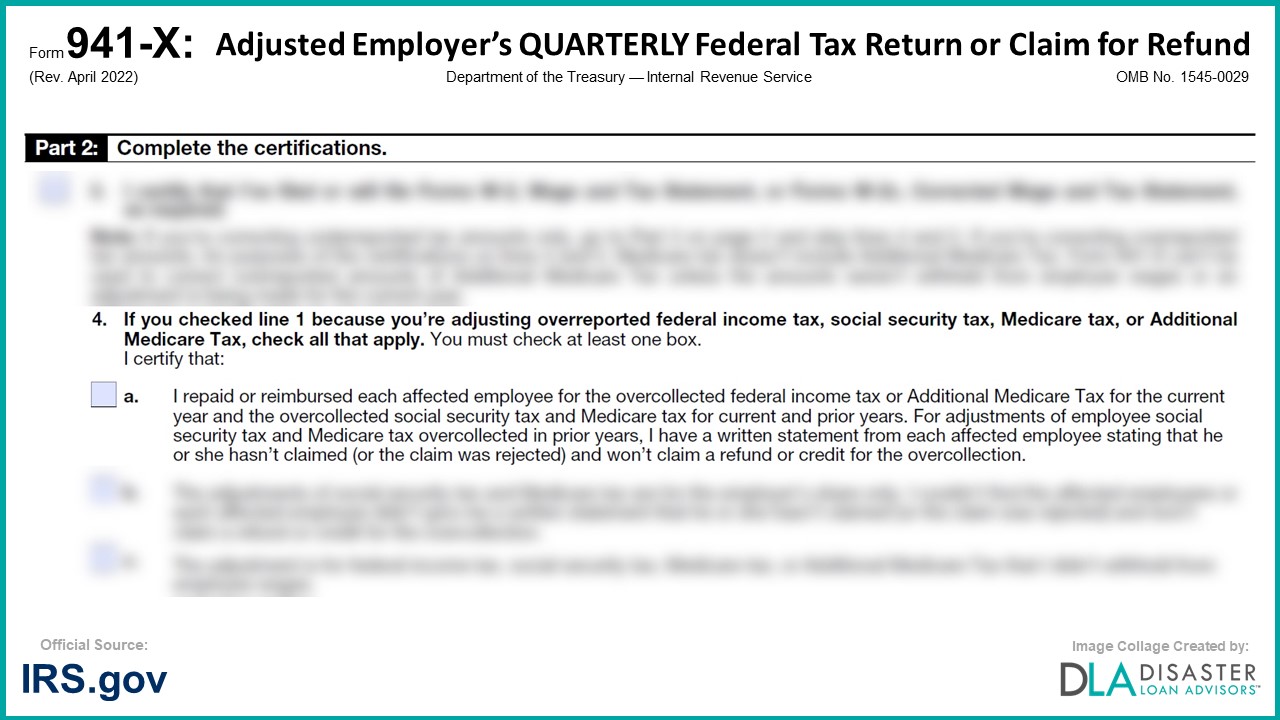

The “Certifying Overreporting Adjustments” section is listed as question #4a under Part 2 of Form 941-X, which is needed to…

The “Certifying Overreporting Adjustments” section is listed as question #4 under Part 2 of Form 941-X, which is needed to…

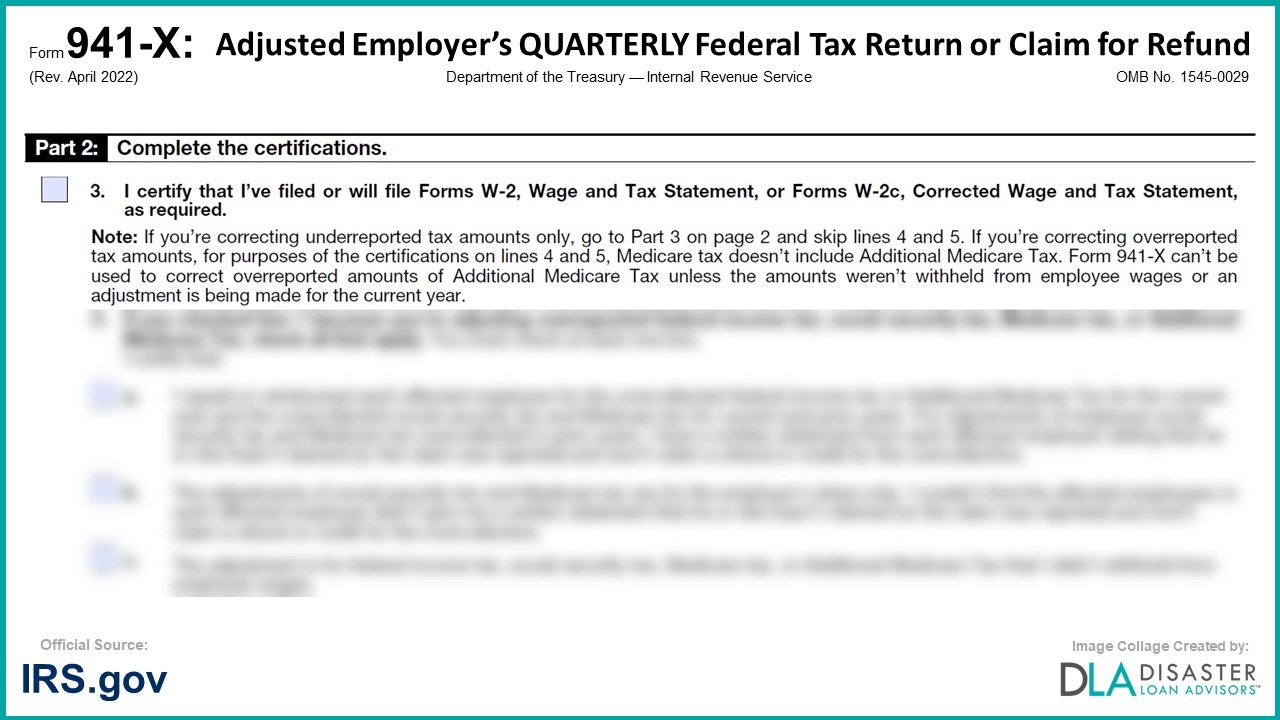

The “Filing Forms W-2 or Forms W-2c” section is listed as question #3 under Part 2 of Form 941-X, which…

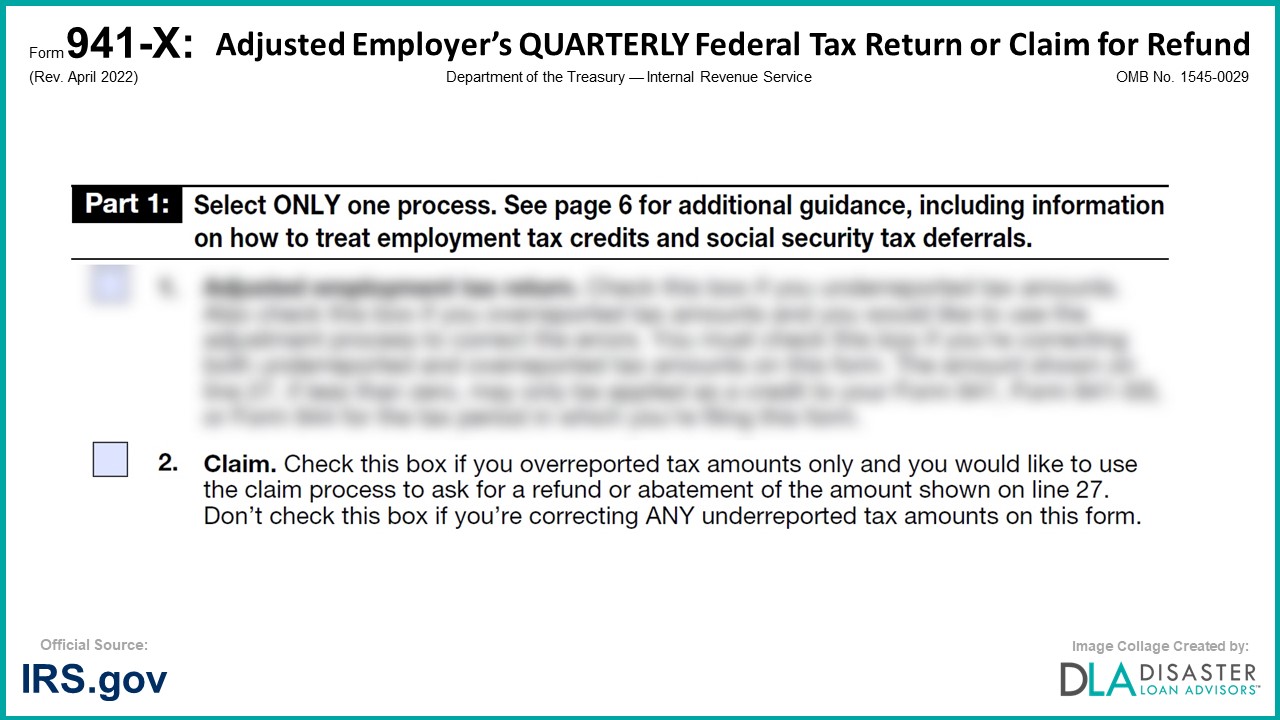

The “Claim” section is listed as question #2 under Part 1 of Form 941-X, which is needed to claim the…

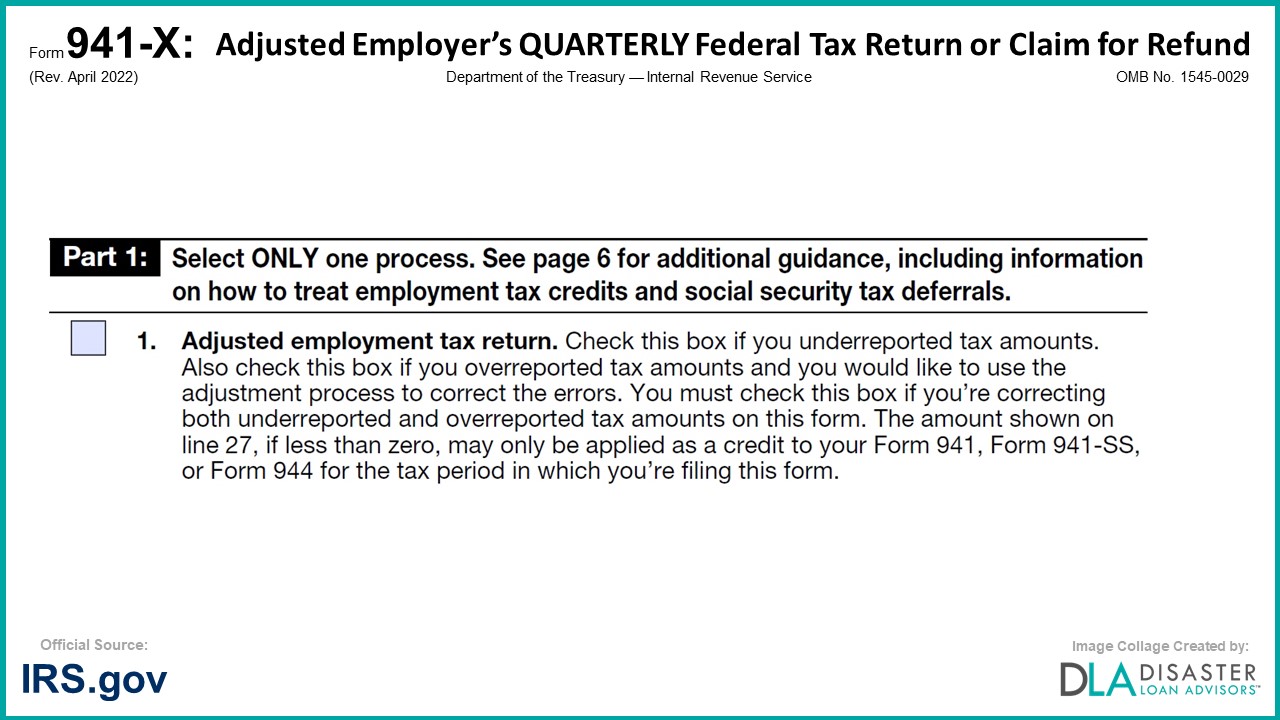

The “Adjusted Employment Tax Return” section is listed as question #1 under Part 1 of Form 941-X, which is needed…