Disaster Loan Advisors™ (DLA) has been seen on…

Employee Retention Tax Credits from the IRS for Employers

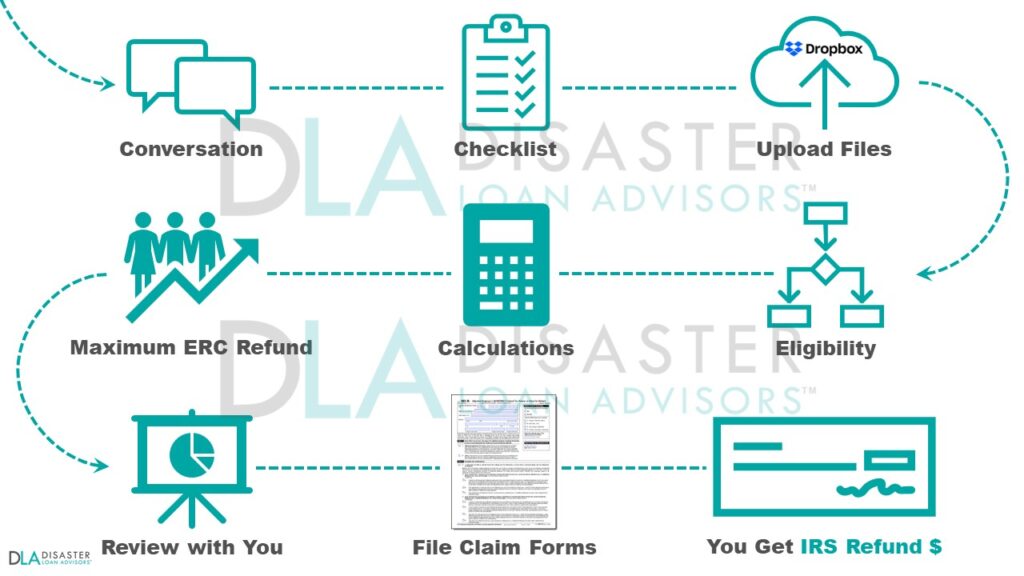

How the Easy 7-Step ERC Process Works With DLA™

The Employee Retention Credit (ERC) is a refundable tax credit program launched by the Internal Revenue Service (IRS) to support small businesses, companies and organizations that paid their workforce W-2 employees on payroll during the most challenging times of the COVID-19 pandemic. March 13, 2020 to September 31, 2021 for most businesses, and through December 31, 2021 for a “recovery startup” business.

In 2024, you can still retroactively claim the ERC credit, even if you received a Paycheck Protection Program (PPP) loan, by successfully filing IRS form 941-X for each quarter that qualifies. IRS business tax refund checks are mailed directly to you from the U.S. Department of the Treasury (USDT).

See the official IRS.gov ERC page to attempt to figure this out yourself. Or, save valuable time and energy to engage the expert consultation of an ERC specialist such as Disaster Loan Advisors™ (DLA) to help you navigate through this confusing and complex ERC claim process.

Schedule your free no-risk, no-obligation, Employee Retention Tax Credit Consultation Call today!

Small Business SBA Emergency Grants and Loans

SBA Coronavirus (COVID-19) Small Business Guidance & Disaster Loan Resources

FAST Help for Small to Mid-Sized (SMB) Business Owners

IRS ERC / ERTC Claims, 941-X Filings, SBA Loans, Application Assistance

GETTING STARTED: Next Steps? Help is Only a Phone Call Away…

Schedule a Call today to speak with one of our Disaster Loan Advisors™ ERC or SBA Experts to explore your time-sensitive options in helping you get your IRS ERC Tax Refund, or SBA Loan ($300k+ and up), to those businesses that qualify.

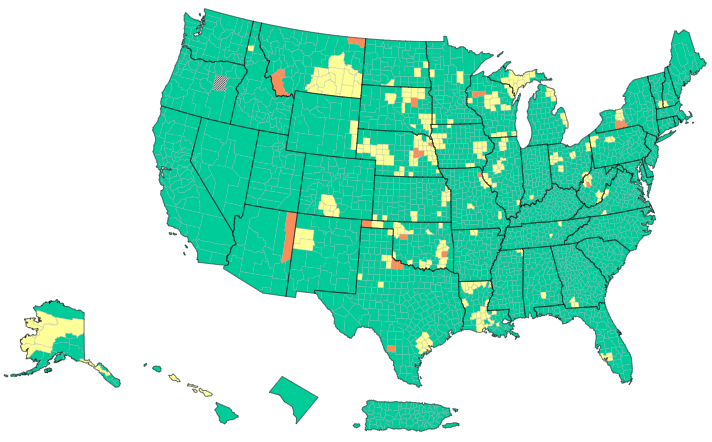

United States COVID Data Tracker Map

Coronavirus COVID-19 United States (USA) Daily Map and Data of Confirmed Cases since the pandemic began in early 2020.

As of May 9, 2024, the Centers for Disease Control and Prevention (CDC) tracked:

– Total Cases = 6,935,240

– Total Deaths = 1,190,122

– Current Hospitalizations = 5,098