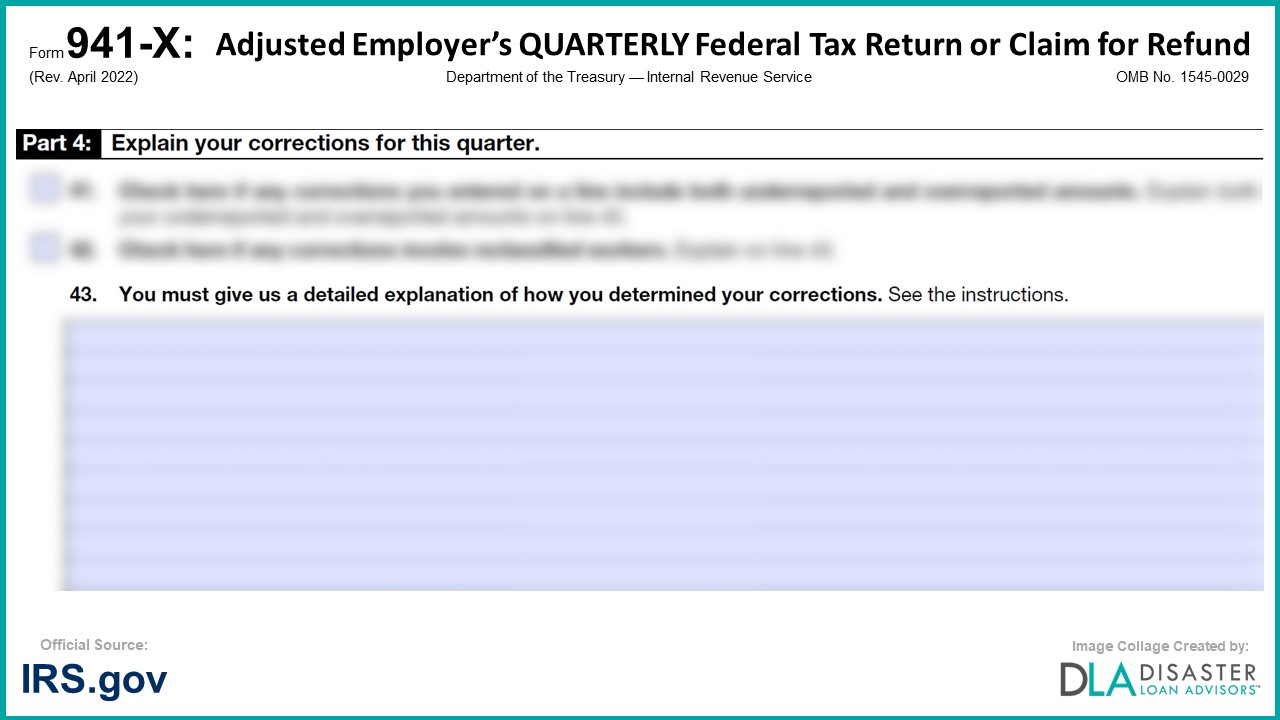

The “Explain Your Corrections” section is listed as question #43 under Part 4 of Form 941-X, which is needed to…

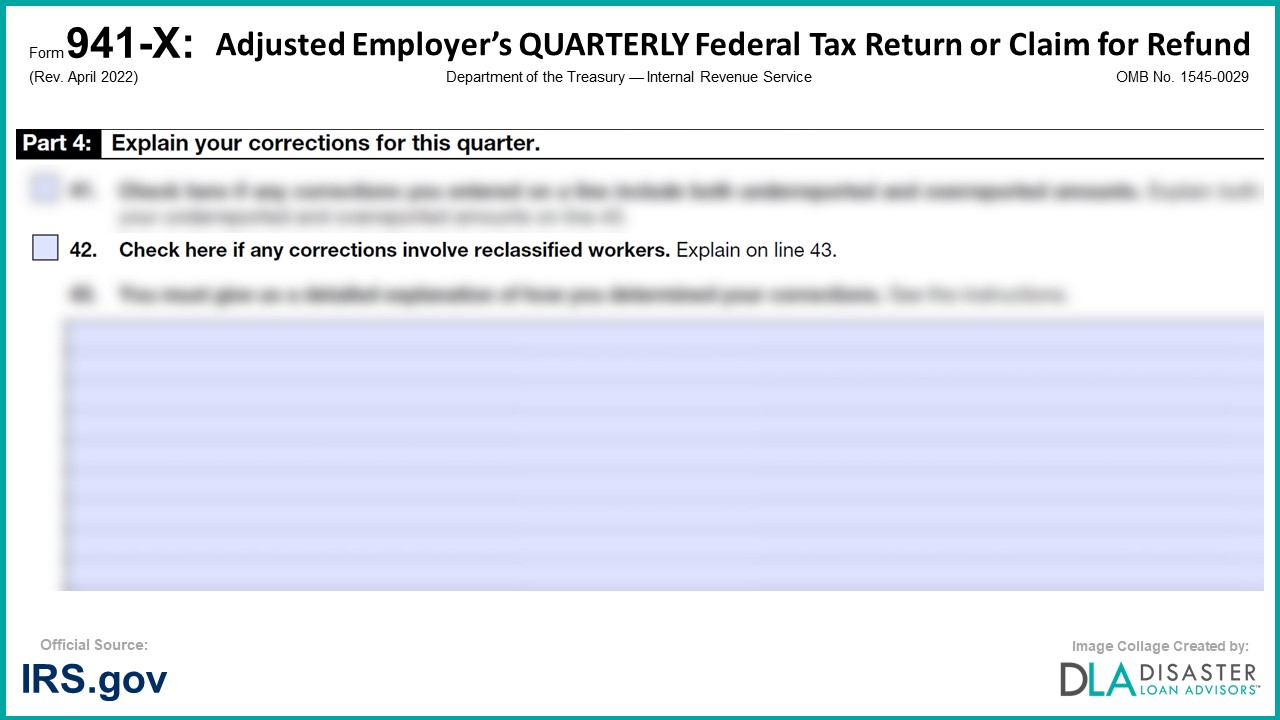

The “Did You Reclassify Any Workers?” section is listed as question #42 under Part 4 of Form 941-X, which is…

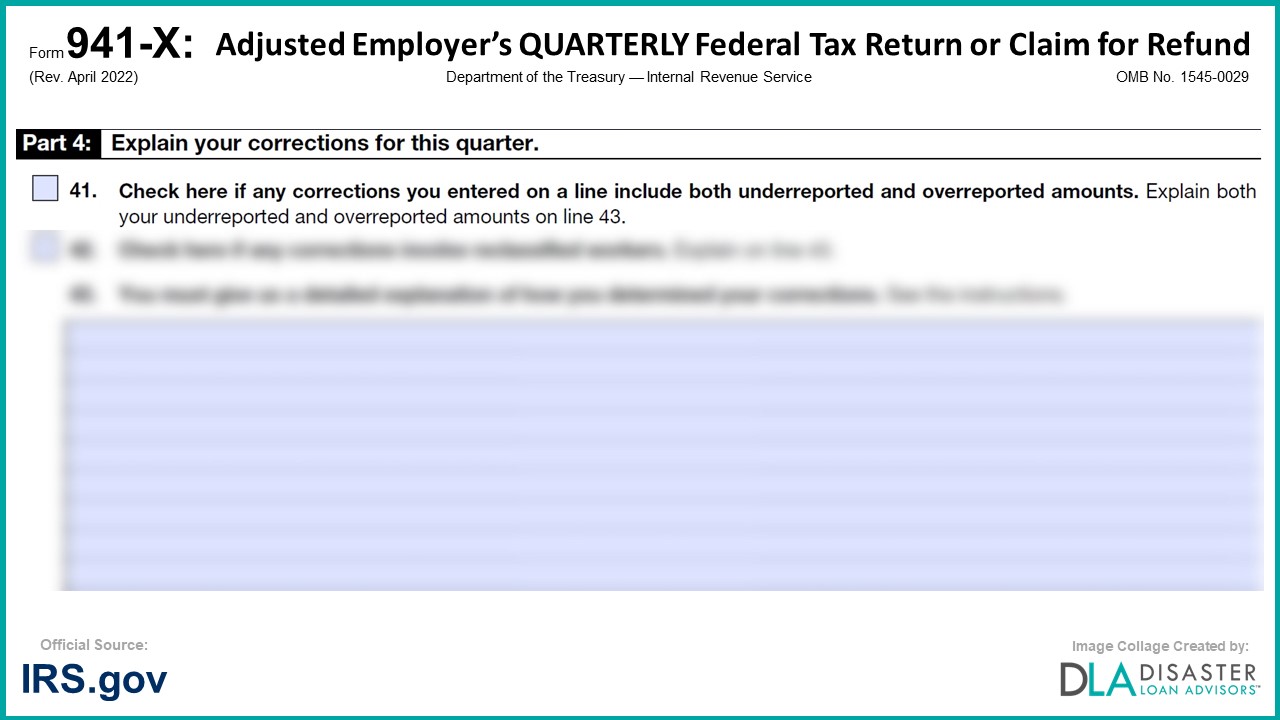

The “Corrections of Both Underreported and Overreported Amounts” section is listed as question #41 under Part 4 of Form 941-X,…

The “Amounts Under Certain Collectively Bargained Agreements Allocable to Qualified Family Leave Wages” section is listed as question #40 under…

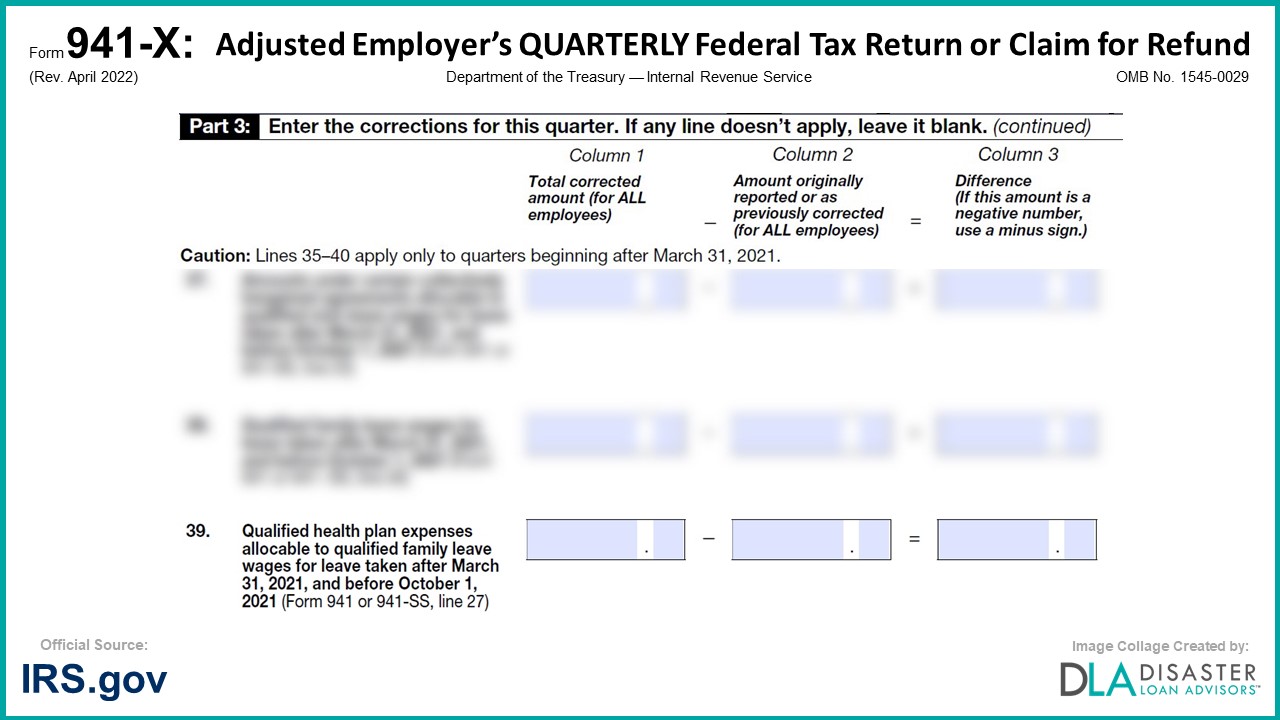

The “Qualified Health Plan Expenses Allocable to Qualified Family Leave Wages” section is listed as question #39 under Part 3…

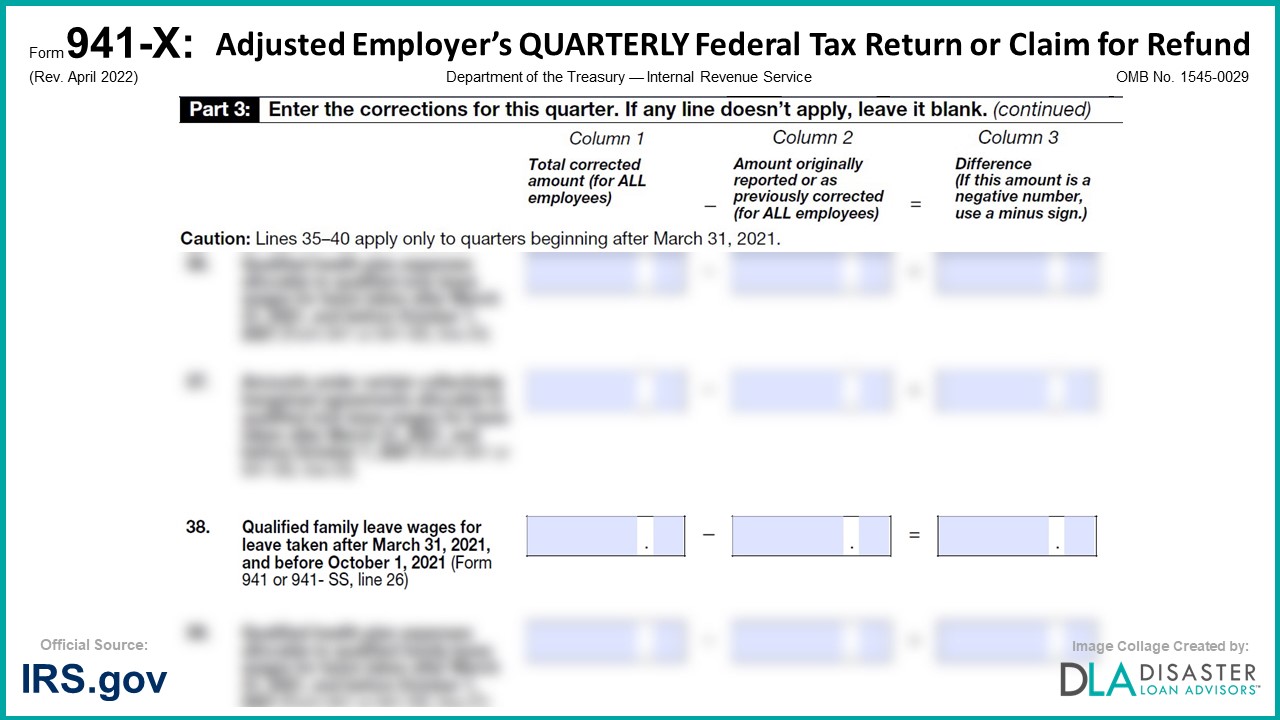

The “Qualified Family Leave Wages for Leave Taken After March 31, 2021, and Before October 1, 2021” section is listed…

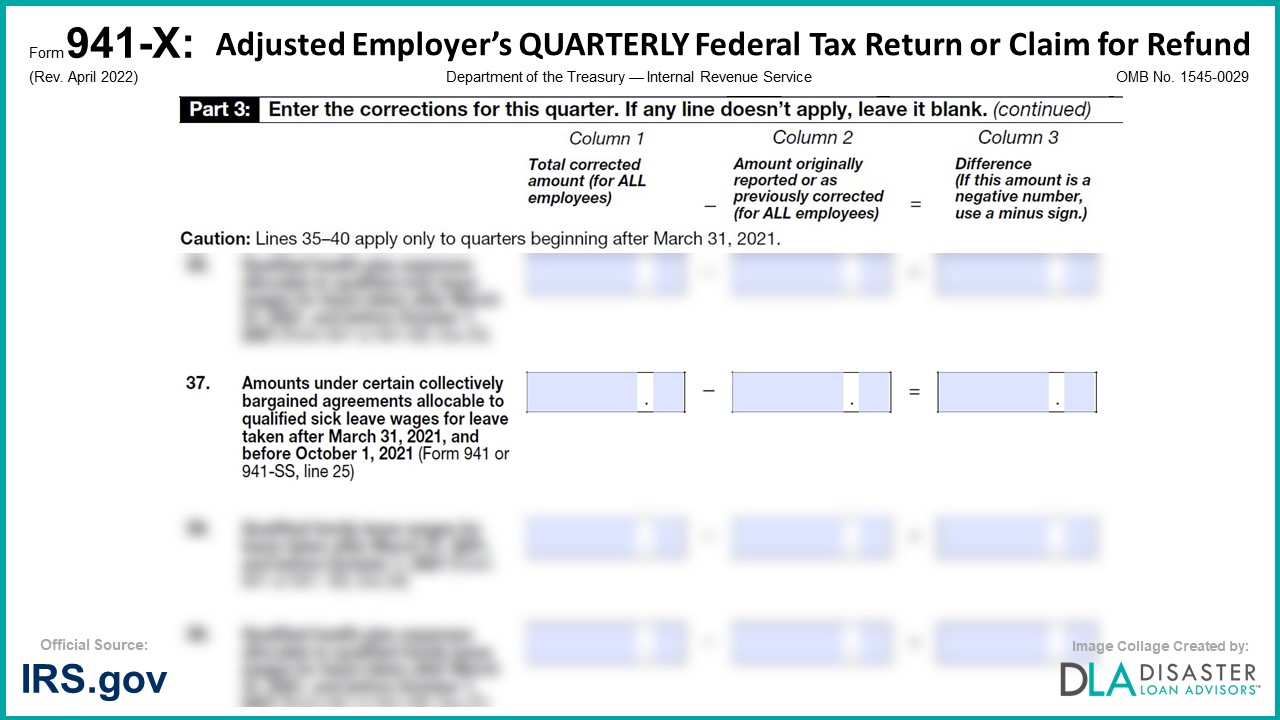

The “Amounts Under Certain Collectively Bargained Agreements Allocable to Qualified Sick Leave Wages” section is listed as question #37 under…

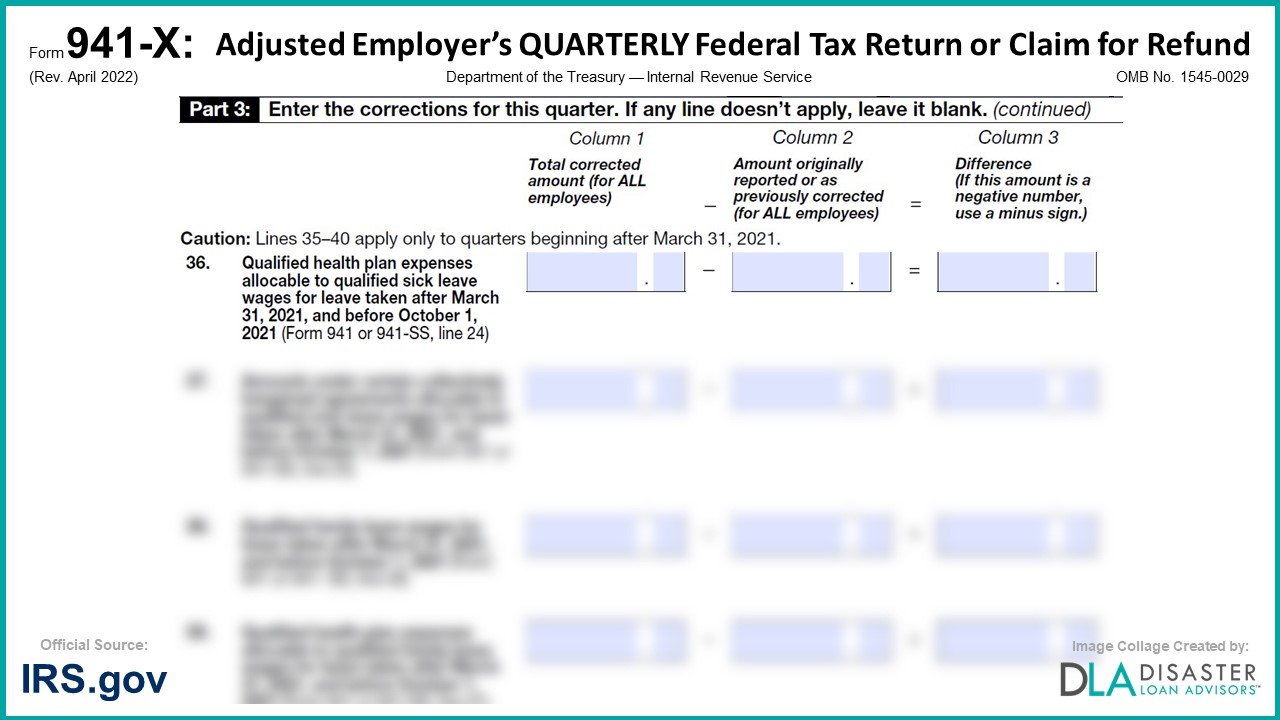

The “Qualified Health Plan Expenses Allocable to Qualified Sick Leave Wages for Leave” section is listed as question #36 under…

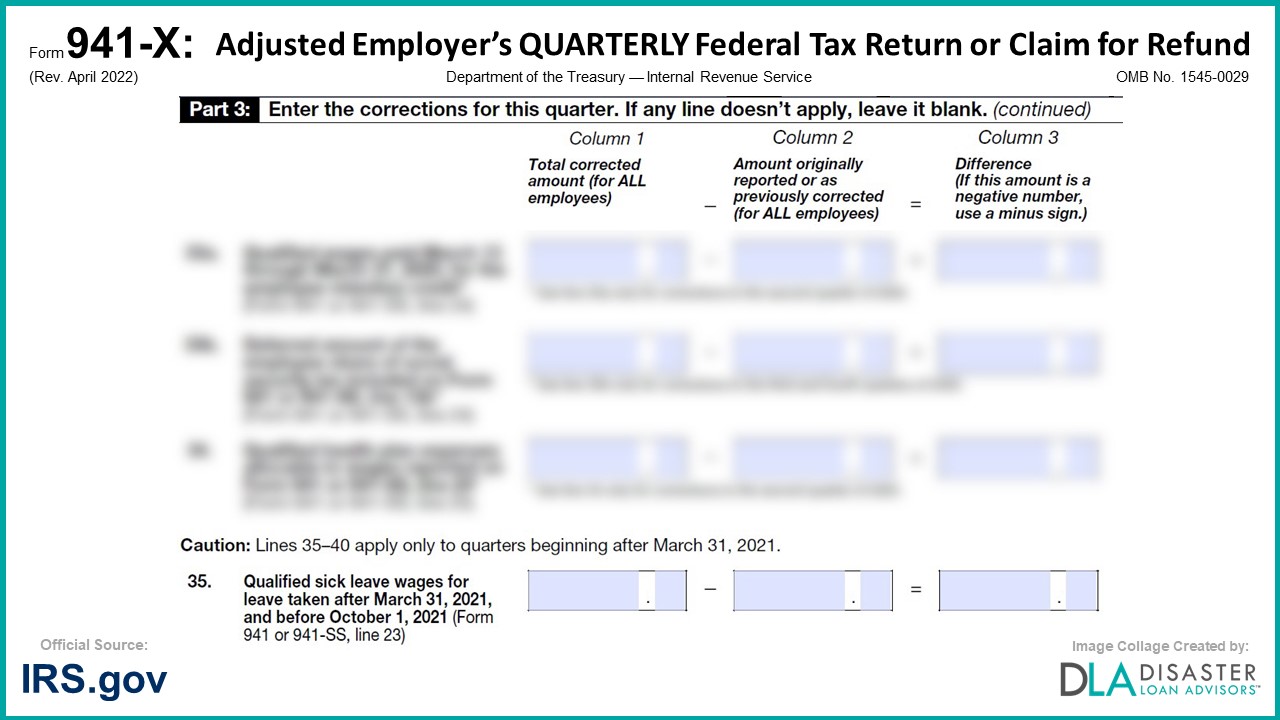

The “Qualified Sick Leave Wages for Leave Taken After March 31, 2021, and Before October 1, 2021” section is listed…

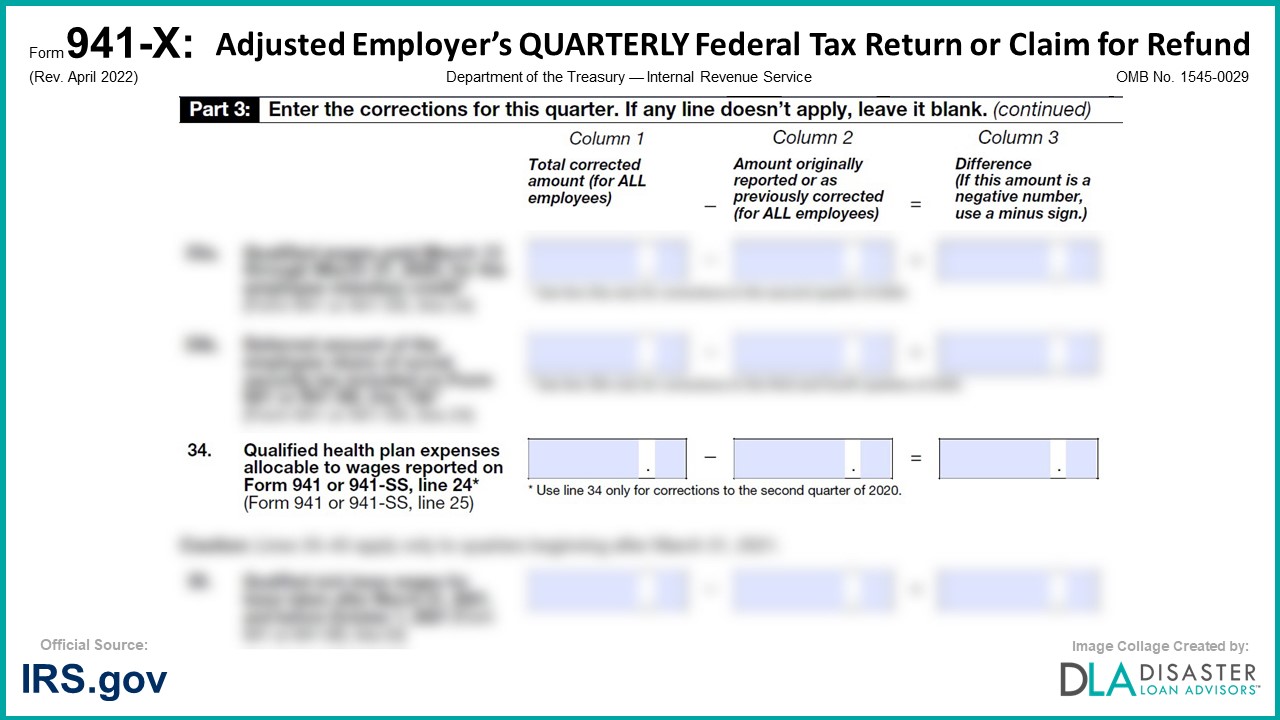

The “Qualified Health Plan Expenses Allocable to Wages Reported on Form 941” section is listed as question #34 under Part…