The “Federal Income Tax Withheld From Wages, Tips, and Other Compensation ” section is listed as question #7 under Part 3 of Form 941-X, which is needed to claim the employee retention tax credit. Instructions are below for the Federal Income Tax Withheld From Wages, Tips, and Other Compensation section.

Key 941-X Tax Form Takeaways:

- Correcting Errors on Time: File corrections for federal income tax withheld from wages within the same calendar year to ensure accuracy and compliance.

- Understanding Error Types: Distinguish between administrative errors, which can be corrected in subsequent years, and other errors, such as incorrect withholding amounts, which typically cannot be adjusted after the year ends.

- Proper Documentation and Filing: Use Form 941-X for corrections, ensuring all changes are accurately reflected and justified in the documentation provided.

See Important 2024 Employee Retention Tax Credit Deadline Information at the Bottom of This Article.

Form 941-X:

7. Federal Income Tax Withheld From Wages, Tips, and Other Compensation

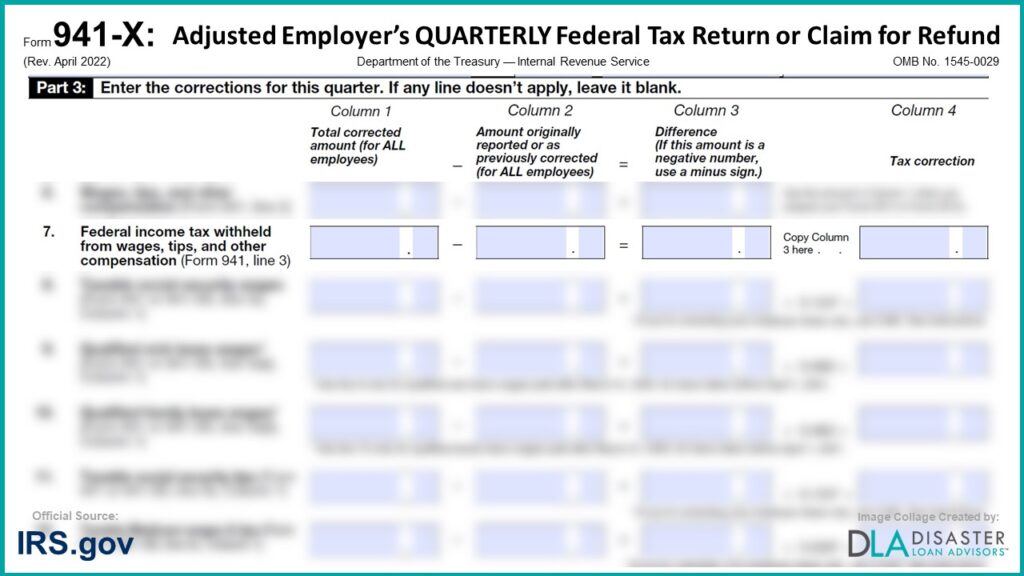

Part 3: Enter the corrections for this quarter. If any line doesn’t apply, leave it blank.

7. Federal income tax withheld from wages, tips, and other compensation (Form 941, line 3)

Adjusted Employer’s QUARTERLY Federal Tax Return or Claim for Refund

Part 3, “7. Federal Income Tax Withheld From Wages, Tips, and Other Compensation “ from Form 941X published by the Department of the Treasury – Internal Revenue Service (IRS), OMB No. 1545-0029, revised in April 2022.

Instructions for Form 941-X:

7. Federal Income Tax Withheld From Wages, Tips, and Other Compensation

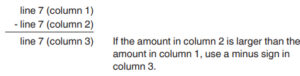

If you’re correcting the federal income tax withheld from wages, tips, and other compensation you reported on Form 941, line 3, enter the total corrected amount in column 1. In column 2, enter the amount you originally reported or as previously corrected. In column 3, enter the difference between columns 1 and 2. This line doesn’t apply to Form 941-SS.

Copy the amount in column 3 to column 4. Include any minus sign shown in column 3.

CAUTION: Generally, you may correct federal income tax withholding errors only if you discovered the errors in the same calendar year you paid the wages. In addition, for an overcollection, you may correct federal income tax withholding only if you also repaid or reimbursed the employees in the same year. For prior years, you may only correct administrative errors to federal income tax withholding (that is, errors in which the amount reported on Form 941, line 3, isn’t the amount you actually withheld from an employee’s wages) and errors for which section 3509 rates apply. Only transposition or math errors involving the inaccurate reporting of the amount withheld are “administrative errors.” See section 13 of Pub. 15 for more information about corrections during the calendar year and about administrative errors. See section 2 of Pub. 15 for more information about section 3509. If section 3509 rates apply, see the instructions for lines 19–22, later.

You can’t file a Form 941-X to correct federal income tax withholding for prior years for nonadministrative errors. In other words, you can’t correct federal income tax actually withheld from an employee in a prior year if you discover that you didn’t withhold the right amount. For example, you can’t correct federal income tax withheld in a prior year because you used the wrong income tax withholding table or you didn’t treat a payment correctly as taxable or nontaxable. Similarly, if you paid federal income tax in a prior year on behalf of your employee, rather than deducting it from the employee’s pay (which resulted in additional wages subject to tax), and in a subsequent year you determine that you incorrectly calculated the amount of tax, you can’t correct the federal income tax withholding.

Example – Prior year nonadministrative error (failure to withhold federal income tax when required). You were required to withhold $400 of federal income tax from an employee’s bonus that was paid in December of 2021 but you withheld nothing. You discovered the error on March 14, 2022. You can’t file Form 941-X to correct federal income tax withheld reported on your 2021 fourth quarter Form 941 because the error involves a previous year and the amount previously reported for the employee represents the actual amount withheld from the employee during 2021.

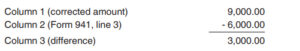

Example – Prior year administrative error (incorrectly reported amount of federal income tax actually withheld). You had three employees. In the fourth quarter of 2021, you withheld $1,000 of federal income tax from Xavier Black, $2,000 from Sophie Rose, and $6,000 from Leo Wood. The total amount of federal ncome tax you withheld was $9,000. You mistakenly reported $6,000 on line 3 of your 2021 fourth quarter Form 941. You discovered the error on March 11, 2022. This is an example of an administrative error that may be corrected in a later calendar year because the amount actually withheld from the employees’ wages isn’t the amount reported on Form 941. Use Form 941-X to correct the error. Enter $9,000 in column 1 and $6,000 in column 2. Subtract the amount in column 2 from the amount in column 1.

Report the $3,000 as a tax correction in column 4.

Be sure to explain the reasons for this correction on line 43.

Example – Nonadministrative error reporting federal income tax because of repayment of wages paid in prior year. You prepaid Jack Brown $4,000 of wages for 2 months of work in September 2021. You withheld $400 of federal income tax at the time you paid Jack. These amounts were reported on your 2021 third quarter Form 941. Jack left employment in October 2021 (after only 1 month of service). In January 2022, Jack repaid $2,000 to you for the 1 month he didn’t work. You can’t file Form 941-X to reduce the federal income tax withheld because you actually withheld the federal income tax from wages. You also can’t file Form 941-X to reduce wages because the wages were income to Jack for the prior year. These amounts were correctly reported on Form 941.

Adjusted Employer’s QUARTERLY Federal Tax Return or Claim for Refund

Instructions for Part 3, “7. Federal Income Tax Withheld From Wages, Tips, and Other Compensation “ came from the IRS Instructions for Form 941-X published by the Internal Revenue Service (IRS) Department of the Treasury, revised in April 2022.

Conclusion and Summary on 941-X: 7. Federal Income Tax Withheld From Wages, Tips, and Other Compensation , Form Instructions

The “Wages, Tips, and Other Compensation” section is just one of forty three detailed questions and calculations you must complete correctly on the 941X IRS Form. Listed as question #7 under Part 3 of the 941X, be sure to answer the Federal Income Tax Withheld From Wages, Tips, and Other Compensation question #7 correctly.

How To Fill Out Form 941-X For the Employee Retention Tax Credit?

Need Help Completing / Filing IRS Form 941-X?

Disaster Loan Advisors can assist your business in filing an amended Form 941 Employer’s Quarterly Federal Tax Return (for 2020 and 2021), which is IRS Form 941-X Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund.

This tax form is required to be filled out correctly and filed for each qualifying quarter in 2020 and 2021 to ensure your business claims the maximum Employee Retention Credit (ERC) / Employee Retention Tax Credit (ERTC).

– Did you calculate your company’s maximum ERC Tax Credit correctly?

– Are you claiming all the ERC Credit for each qualifying quarter?

– Are you maximizing the total amount of ERC Credit your company qualifies for?

– Need a professional set of eyes to ensure you filled out your form 941X correctly?

Flexible and Professional ERC Consulting Tax Services

There are several flexible options for you. We can review, prepare, and / or file your 941-X Forms for you, or with you.

– Do-It-Yourself (DIY) and have us review your work.

– Done-With-You (DWY) and let’s collaborate together.

– Done-For-You (DFY) and we handle it all for you, from start to finish.

– Or, Consult-With-You to customize to your exact needs.

Our professional ERC fee and pricing structure is very reasonable in comparison.

We DO NOT charge a percentage (%) of your ERC Refund like some companies are charging. Some ERC firms out there are charging upwards of 25% to 35% of your ERC refund!

If you are looking for an ERC Company that believes in providing professional ERC Tax Services and value for small business owners, in exchange for a fair, reasonable, and ethical flat-fee for the amount of work required, Disaster Loan Advisors is a good fit for you.

Form 941-X and the ERC program can be very confusing as it relates to your specific business situation. Our fee structure is fair and reasonable for the same or better level of ERC service.

Schedule Your Form 941-X Consultation to have peace of mind you are making sure your company actually qualifies, AND you are calculating the employee retention tax credit properly.

Deadlines to File IRS Form 941-X in 2024 and 2025

The 2020 ERC Credit Tax Year deadline of 4/15/24 has already passed. Good news? The opportunity to retroactively claim your business Employee Retention Credit for the prior 2021 Tax Year is still available, with a next year April 15, 2025 deadline.

This really is your FINAL chance at any potential ERC tax credit refund!

How to Claim the Employee Retention Tax Credit (ERC / ERTC) and Receive Up to a $26,000 Refund Per Employee

Disaster Loan Advisors can assist your business with the complex and confusing Employee Retention Credit (ERC) and Employee Retention Tax Credit (ERTC) program.

Depending on eligibility, business owners and companies can receive up to $26,000 per employee based on the number of W2 employees you had on the payroll in 2020 and 2021.

The ERC / ERTC Program is a valuable tax credit you can claim. This is money you have already paid to the IRS in payroll taxes for your W2 employees.

Schedule Your Free Employee Retention Credit Consultation to see if your company qualifies for the employee retention tax credit.

Cover Image Credit: Irs.gov / Form 941-X / Disaster Loan Advisors.