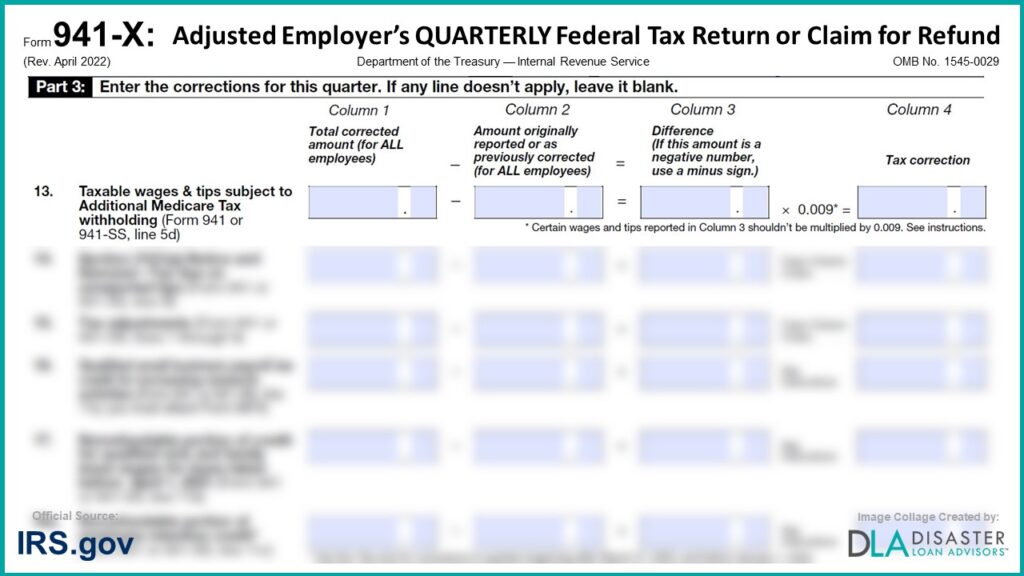

The “Taxable Wages and Tips Subject to Additional Medicare Tax Withholding” section is listed as question #13 under Part 3 of Form 941-X, which is needed to claim the employee retention tax credit. Instructions are below for the Taxable Wages and Tips Subject to Additional Medicare Tax Withholding section.

Key 941-X Tax Form Takeaways:

- Essential for Corrections: Form 941-X is a crucial tool for businesses to correct errors made in previously filed Form 941s. It can be used to either report underreported tax amounts or claim refunds for overreported amounts.

- Detailed Guidance Available: The form includes comprehensive instructions that are vital for ensuring compliance and making accurate reports of adjustments.

- Flexible and Professional Support Options: For businesses needing assistance with Form 941-X, there are several service options ranging from do-it-yourself reviews to full professional handling of the form.

See Important 2024 Employee Retention Tax Credit Deadline Information at the Bottom of This Article.

Form 941-X:

13. Taxable Wages and Tips Subject to Additional Medicare Tax Withholding

Part 3: Enter the corrections for this quarter. If any line doesn’t apply, leave it blank.

13. Taxable wages & tips subject to Additional Medicare Tax withholding (Form 941 or 941-SS, line 5d)

Adjusted Employer’s QUARTERLY Federal Tax Return or Claim for Refund

Part 3, “13. Taxable Wages and Tips Subject to Additional Medicare Tax Withholding“ from Form 941X published by the Department of the Treasury – Internal Revenue Service (IRS), OMB No. 1545-0029, revised in April 2022.

Instructions for Form 941-X:

13. Taxable Wages and Tips Subject to Additional Medicare Tax Withholding

Generally, you may correct errors to Additional Medicare Tax withholding only if you discovered the errors in the same calendar year the wages and tips were paid to employees. However, you may correct errors to Additional Medicare Tax withholding for prior years if the amount reported on Form 941, line 5d, column 2, isn’t the amount you actually withheld, including any amount you paid on behalf of your employee rather than deducting it from the employee’s pay (which resulted in additional wages subject to tax). This type of error is an administrative error. The administrative error adjustment corrects the amount reported on Form 941 to agree with the amount actually withheld from employees.

You may also correct errors to Additional Medicare Tax withholding for prior years if section 3509 rates apply. If section 3509 rates apply, see the instructions for lines 19– 22, later.

If a prior year error was a nonadministrative error, you may correct only the wages and tips subject to Additional Medicare Tax withholding that were originally reported on Form 941, line 5d, column 1, or previously corrected on Form 941-X. You can’t correct the tax reported on Form 941, line 5d, column 2.

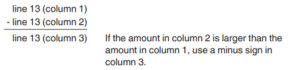

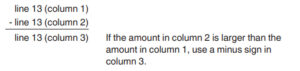

Errors discovered in the same calendar year or prior year administrative errors. If you’re correcting the taxable wages and tips subject to Additional Medicare Tax withholding that you reported on Form 941, line 5d, column 1, enter the total corrected amount in column 1. In column 2, enter the amount you originally reported or as previously corrected. In column 3, enter the difference between columns 1 and 2.

Multiply the amount in column 3 by 0.009 (0.9% tax rate) and enter that result in column 4.

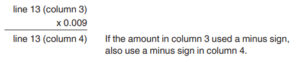

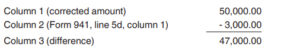

Example – Prior year administrative error (incorrectly reported amount of Additional Medicare Tax actually withheld). Xavier Black’s wages exceeded the $200,000 withholding threshold for Additional Medicare Tax in November 2021. The total wages paid to Xavier for 2021 were $230,000. You withheld $270 ($30,000 x 0.009) from Xavier’s wages. However, on your fourth quarter 2021 Form 941, you mistakenly reported $3,000 on line 5d, column 1, and Additional Medicare Tax withheld of $27 on line 5d, column 2. You discover the error on March 14, 2022. This is an example of an administrative error that may be corrected in a later calendar year because the amount actually withheld isn’t the amount reported on your fourth quarter 2021 Form 941. Use Form 941-X, line 13, to correct the error as shown below.

Use the difference in column 3 to determine your tax correction.

Be sure to explain the reasons for this correction on line 43.

Prior year nonadministrative errors. You may correct only the taxable wages and tips subject to Additional Medicare Tax withholding that you reported on Form 941, line 5d, column 1. Enter the total corrected amount in column 1. In column 2, enter the amount you originally reported or as previously corrected. In column 3, enter the difference between columns 1 and 2.

Don’t multiply the amount in column 3 by 0.009 (0.9% tax rate). Leave column 4 blank and explain the reasons for this correction on line 43.

Example – Prior year nonadministrative error (failure to withhold Additional Medicare Tax when required). Sophie Rose’s wages exceeded the $200,000 withholding threshold for Additional Medicare Tax in December 2021. The total wages paid to Sophie for 2021 were $220,000. You were required to withhold $180 ($20,000 x 0.009) but you withheld nothing and didn’t report an amount on line 5d of your fourth quarter 2021 Form 941. You discover the error on March 14, 2022. File Form 941-X to correct wages and tips subject to Additional Medicare Tax withholding for your 2021 fourth quarter Form 941, but you may not correct the Additional Medicare Tax withheld (column 4) because the error involves a previous year and the amount previously reported for Sophie represents the actual amount withheld from Sophie during 2021.

Combination of prior year administrative and nonadministrative errors. If you’re reporting both administrative errors and nonadministrative errors for the same quarter of a prior year, enter the total corrected amount in column 1. In column 2, enter the amount you originally reported or as previously corrected. In column 3, enter the difference between columns 1 and 2. However, multiply only the amount of wages and tips reported in column 3 that are related to administrative errors by 0.009 (0.9% tax rate). Don’t multiply any wages and tips reported in column 3 that are related to nonadministrative errors by 0.009 (0.9% tax rate). Use line 43 to explain in detail your corrections. The explanation must include the reasons for the corrections and a breakdown of the amount reported in column 3 into the amounts related to administrative errors and nonadministrative errors.

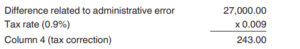

Example – Combination of prior year administrative and nonadministrative errors. Xavier Black’s wages exceeded the $200,000 withholding threshold for Additional Medicare Tax in November 2021. The total wages paid to Xavier for 2021 were $230,000. You withheld $270 ($30,000 x 0.009) from Xavier’s wages. However, on your fourth quarter 2021 Form 941, you mistakenly reported $3,000 on line 5d, column 1, and Additional Medicare Tax withheld of $27 on line 5d, column 2. The difference in wages subject to Additional Medicare Tax related to this administrative error is $27,000 ($30,000 – $3,000).

Sophie Rose’s wages exceeded the $200,000 withholding threshold for Additional Medicare Tax in December 2021. The total wages paid to Sophie for 2021 were $220,000. You were required to withhold $180 ($20,000 x 0.009) but you withheld nothing and didn’t report Sophie’s $20,000 in wages subject to Additional Medicare Tax withholding on line 5d of your fourth quarter 2021 Form 941.

You discover both errors on March 14, 2022. Use Form 941-X, line 13, to correct the errors as shown below.

Determine the portion of wages and tips reported in column 3 that is related to the administrative error ($47,000 – $20,000 (nonadministrative error) = $27,000 (administrative error)). Multiply this portion of column 3 by 0.009 (0.9% tax rate) to determine your tax correction.

Be sure to explain the reasons for these corrections on line 43. You must also report that $20,000 of the amount shown in column 3 was related to the correction of a prior year nonadministrative error and $27,000 of the amount shown in column 3 was related to the correction of an administrative error.

Adjusted Employer’s QUARTERLY Federal Tax Return or Claim for Refund

Instructions for Part 3, “13. Taxable Wages and Tips Subject to Additional Medicare Tax Withholding“ came from the IRS Instructions for Form 941-X published by the Internal Revenue Service (IRS) Department of the Treasury, revised in April 2022.

Conclusion and Summary on 941-X: 13. Taxable Wages and Tips Subject to Additional Medicare Tax Withholding, Form Instructions

The “Taxable Wages and Tips Subject to Additional Medicare Tax Withholding” section is just one of forty three detailed questions and calculations you must complete correctly on the 941X IRS Form. Listed as question #13 under Part 3 of the 941X, be sure to answer the Taxable Wages and Tips Subject to Additional Medicare Tax Withholding question #13 correctly.

How To Fill Out Form 941-X For the Employee Retention Tax Credit?

Need Help Completing / Filing IRS Form 941-X?

Disaster Loan Advisors can assist your business in filing an amended Form 941 Employer’s Quarterly Federal Tax Return (for 2020 and 2021), which is IRS Form 941-X Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund.

This tax form is required to be filled out correctly and filed for each qualifying quarter in 2020 and 2021 to ensure your business claims the maximum Employee Retention Credit (ERC) / Employee Retention Tax Credit (ERTC).

– Did you calculate your company’s maximum ERC Tax Credit correctly?

– Are you claiming all the ERC Credit for each qualifying quarter?

– Are you maximizing the total amount of ERC Credit your company qualifies for?

– Need a professional set of eyes to ensure you filled out your form 941X correctly?

Flexible and Professional ERC Consulting Tax Services

There are several flexible options for you. We can review, prepare, and / or file your 941-X Forms for you, or with you.

– Do-It-Yourself (DIY) and have us review your work.

– Done-With-You (DWY) and let’s collaborate together.

– Done-For-You (DFY) and we handle it all for you, from start to finish.

– Or, Consult-With-You to customize to your exact needs.

Our professional ERC fee and pricing structure is very reasonable in comparison.

We DO NOT charge a percentage (%) of your ERC Refund like some companies are charging. Some ERC firms out there are charging upwards of 25% to 35% of your ERC refund!

If you are looking for an ERC Company that believes in providing professional ERC Tax Services and value for small business owners, in exchange for a fair, reasonable, and ethical flat-fee for the amount of work required, Disaster Loan Advisors is a good fit for you.

Form 941-X and the ERC program can be very confusing as it relates to your specific business situation. Our fee structure is fair and reasonable for the same or better level of ERC service.

Schedule Your Form 941-X Consultation to have peace of mind you are making sure your company actually qualifies, AND you are calculating the employee retention tax credit properly.

Deadlines to File IRS Form 941-X in 2024 and 2025

The 2020 ERC Credit Tax Year deadline of 4/15/24 has already passed. Good news? The opportunity to retroactively claim your business Employee Retention Credit for the prior 2021 Tax Year is still available, with a next year April 15, 2025 deadline.

This really is your FINAL chance at any potential ERC tax credit refund!

How to Claim the Employee Retention Tax Credit (ERC / ERTC) and Receive Up to a $26,000 Refund Per Employee

Disaster Loan Advisors can assist your business with the complex and confusing Employee Retention Credit (ERC) and Employee Retention Tax Credit (ERTC) program.

Depending on eligibility, business owners and companies can receive up to $26,000 per employee based on the number of W2 employees you had on the payroll in 2020 and 2021.

The ERC / ERTC Program is a valuable tax credit you can claim. This is money you have already paid to the IRS in payroll taxes for your W2 employees.

Schedule Your Free Employee Retention Credit Consultation to see if your company qualifies for the employee retention tax credit.

Cover Image Credit: Irs.gov / Form 941-X / Disaster Loan Advisors.