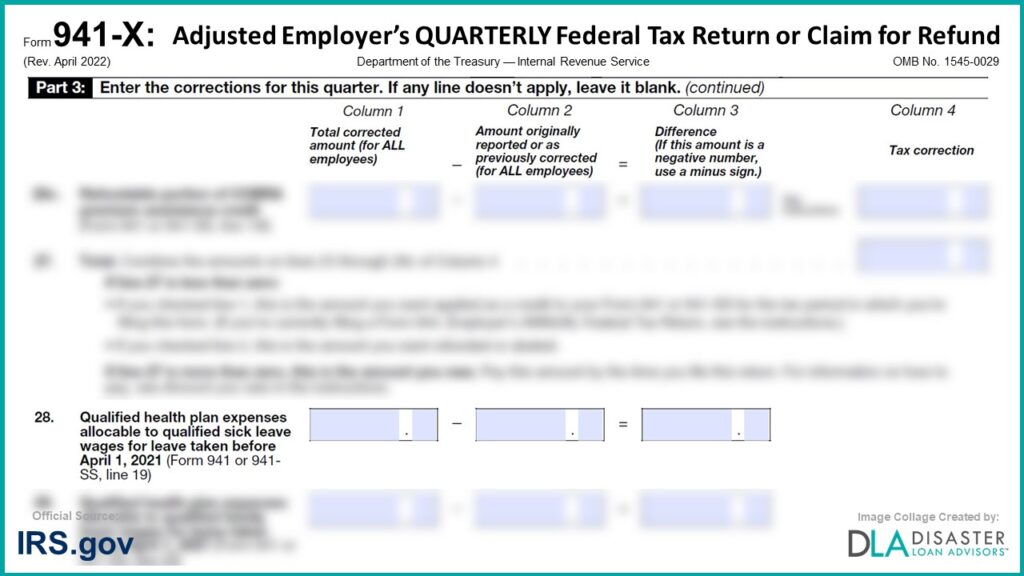

The “Qualified Health Plan Expenses Allocable to Qualified Sick Leave Wages” section is listed as question #28 under Part 3 of Form 941-X, which is needed to claim the employee retention tax credit. Instructions are below for the Qualified Health Plan Expenses Allocable to Qualified Sick Leave Wages section.

Key 941-X Tax Form Takeaways:

- Specific Instructions for Form 941-X: The section “Qualified Health Plan Expenses Allocable to Qualified Sick Leave Wages” in Form 941-X requires employers to accurately report adjusted amounts for health plan expenses related to sick leave wages for specific periods, ensuring compliance and correct claim amounts.

- Amendment and Claiming Process: This part of the form is crucial for businesses looking to amend previously submitted tax returns to claim the Employee Retention Credit, involving detailed corrections of originally reported amounts.

- Professional Assistance Available: Given the complexity of filing such amendments, professional consulting services like Disaster Loan Advisors offer specialized support to help businesses navigate and maximize their potential claims, ensuring accuracy and compliance without excessive fees.

See Important 2024 Employee Retention Tax Credit Deadline Information at the Bottom of This Article.

Form 941-X:

28. Qualified Health Plan Expenses Allocable to Qualified Sick Leave Wages

Part 3: Enter the corrections for this quarter. If any line doesn’t apply, leave it blank. (continued)

28. Qualified health plan expenses allocable to qualified sick leave wages for leave taken before April 1, 2021 (Form 941 or 941- SS, line 19)

Adjusted Employer’s QUARTERLY Federal Tax Return or Claim for Refund

Part 3, “28. Qualified Health Plan Expenses Allocable to Qualified Sick Leave Wages“ from Form 941X published by the Department of the Treasury – Internal Revenue Service (IRS), OMB No. 1545-0029, revised in April 2022.

Instructions for Form 941-X:

28. Qualified Health Plan Expenses Allocable to Qualified Sick Leave Wages

If you’re correcting the qualified health plan expenses allocable to qualified sick leave wages for leave taken after March 31, 2020, and before April 1, 2021, that you reported on Form 941, line 19, enter the total corrected amount for all employees in column 1.

In column 2, enter the amount you originally reported or as previously corrected. In column 3, enter the difference between columns 1 and 2. Enter the corrected amount from column 1 on Worksheet 1, Step 2, line 2b.

Adjusted Employer’s QUARTERLY Federal Tax Return or Claim for Refund

Instructions for Part 3, “28. Qualified Health Plan Expenses Allocable to Qualified Sick Leave Wages“ came from the IRS Instructions for Form 941-X published by the Internal Revenue Service (IRS) Department of the Treasury, revised in April 2022.

Conclusion and Summary on 941-X: 28. Qualified Health Plan Expenses Allocable to Qualified Sick Leave Wages, Form Instructions

The “Qualified Health Plan Expenses Allocable to Qualified Sick Leave Wages” section is just one of forty three detailed questions and calculations you must complete correctly on the 941X IRS Form. Listed as question #28 under Part 3 of the 941X, be sure to answer the Qualified Health Plan Expenses Allocable to Qualified Sick Leave Wages question #28 correctly.

How To Fill Out Form 941-X For the Employee Retention Tax Credit?

Need Help Completing / Filing IRS Form 941-X?

Disaster Loan Advisors can assist your business in filing an amended Form 941 Employer’s Quarterly Federal Tax Return (for 2020 and 2021), which is IRS Form 941-X Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund.

This tax form is required to be filled out correctly and filed for each qualifying quarter in 2020 and 2021 to ensure your business claims the maximum Employee Retention Credit (ERC) / Employee Retention Tax Credit (ERTC).

– Did you calculate your company’s maximum ERC Tax Credit correctly?

– Are you claiming all the ERC Credit for each qualifying quarter?

– Are you maximizing the total amount of ERC Credit your company qualifies for?

– Need a professional set of eyes to ensure you filled out your form 941X correctly?

Flexible and Professional ERC Consulting Tax Services

There are several flexible options for you. We can review, prepare, and / or file your 941-X Forms for you, or with you.

– Do-It-Yourself (DIY) and have us review your work.

– Done-With-You (DWY) and let’s collaborate together.

– Done-For-You (DFY) and we handle it all for you, from start to finish.

– Or, Consult-With-You to customize to your exact needs.

Our professional ERC fee and pricing structure is very reasonable in comparison.

We DO NOT charge a percentage (%) of your ERC Refund like some companies are charging. Some ERC firms out there are charging upwards of 25% to 35% of your ERC refund!

If you are looking for an ERC Company that believes in providing professional ERC Tax Services and value for small business owners, in exchange for a fair, reasonable, and ethical flat-fee for the amount of work required, Disaster Loan Advisors is a good fit for you.

Form 941-X and the ERC program can be very confusing as it relates to your specific business situation. Our fee structure is fair and reasonable for the same or better level of ERC service.

Schedule Your Form 941-X Consultation to have peace of mind you are making sure your company actually qualifies, AND you are calculating the employee retention tax credit properly.

Deadlines to File IRS Form 941-X in 2024 and 2025

The 2020 ERC Credit Tax Year deadline of 4/15/24 has already passed. Good news? The opportunity to retroactively claim your business Employee Retention Credit for the prior 2021 Tax Year is still available, with a next year April 15, 2025 deadline.

This really is your FINAL chance at any potential ERC tax credit refund!

How to Claim the Employee Retention Tax Credit (ERC / ERTC) and Receive Up to a $26,000 Refund Per Employee

Disaster Loan Advisors can assist your business with the complex and confusing Employee Retention Credit (ERC) and Employee Retention Tax Credit (ERTC) program.

Depending on eligibility, business owners and companies can receive up to $26,000 per employee based on the number of W2 employees you had on the payroll in 2020 and 2021.

The ERC / ERTC Program is a valuable tax credit you can claim. This is money you have already paid to the IRS in payroll taxes for your W2 employees.

Schedule Your Free Employee Retention Credit Consultation to see if your company qualifies for the employee retention tax credit.

Cover Image Credit: Irs.gov / Form 941-X / Disaster Loan Advisors.